About Us

Our Story

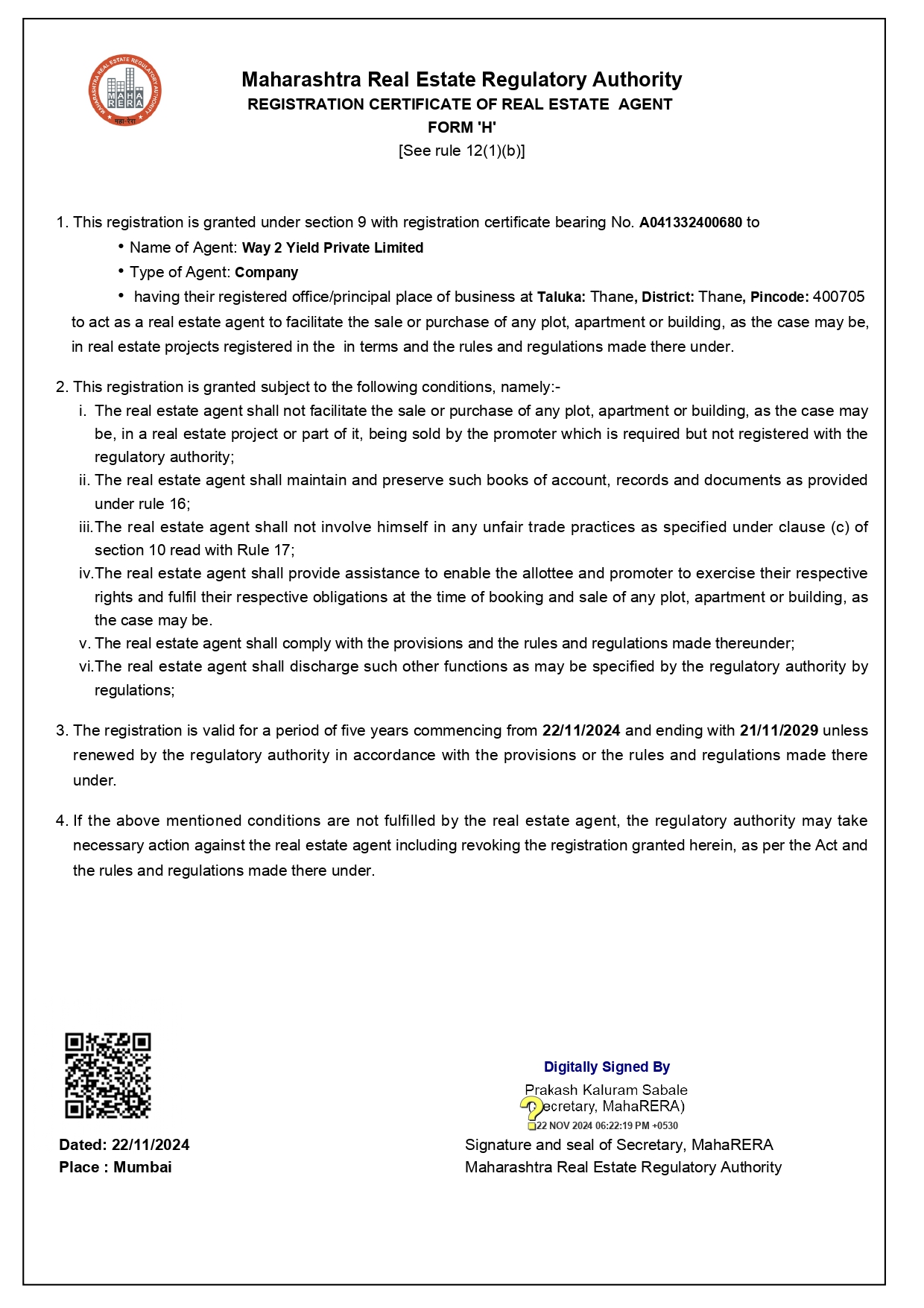

Way 2 Yeild stands as the premier and most seasoned fractional ownership platform within the nation, operating precisely at the crossroads of real estate and technology. Our journey commenced in 2019, propelled by a vision to level the playing field for real estate access. Once an arena exclusively reserved for the exceedingly affluent and institutional entities, we embarked on a mission to transform it. Our ultimate aim revolves around evolving into a worldwide real estate market, thereby introducing this highly profitable asset category to the everyday investor.

Perfect Residential for The Whole Family

Risk Free Investment

Eye Catching Properties

24x7 Help Support

We are A Full Real-Estate Service

Our Listings

Our listings are spread across Grade A properties leased to blue-chip multinationals in Maharashtra.

Building 1

Vashi

Building 2

Prabhadevi

Building 3

Nerul

You’re In good Hands

“Embrace the Assurance of Expert Guidance with Our Corporate Real Estate Services. Navigating the intricate landscape of corporate real estate demands more than knowledge – it requires a trusted partner. Here, ‘You’re in Good Hands’ isn’t just a phrase; it’s a commitment we uphold. Our seasoned professionals seamlessly blend industry acumen with personalized attention, offering you a steady compass in the dynamic world of corporate real estate. With us, your objectives become our mission, and your success is our paramount concern. Experience the confidence that comes with knowing you have a dedicated ally, ensuring your corporate real estate ventures are not only successful but also secure.”

How fractional ownership is different from REITs

Demand for Indian commercial real estate is also evident in the recent over-subscription of India’s first REITs (Real Estate Investment Trusts), raising ₹4,750 crores (US$ 679.64 million). While this robust response clearly demonstrated to investors — domestic and international — that the Indian commercial property market is ready for bigger and more players, REITs have their own disadvantages as well. The concept of REITs is similar to that of mutual funds, pooling money from many investors to purchase or finance income-producing properties, including both residential and commercial realty. The returns paid to investors come from the monthly rents, so there is a steady flow of income.

However, unlike fractional ownership, REITs do not offer much in the way of capital appreciation. And similar to mutual funds, REIT investors cannot choose the particular properties that their money is poured into. Fractional ownership, on the other hand, provides complete control of both, asset selection and diversification. Over time as well, investors gain from both regular rental yield, as well as study capital appreciation.

Way2yield ensures that investors enjoy complete access and transparency when it comes to their properties. All the information is live and accessible at the click of a button on the Way2yield digital platform. Not only can investors take virtual tours of the property, but they can also securely buy and sell their share of the property on the same platform. In addition, hBits only offers the best Grade A commercial properties that are completed and pre-leased, reducing the risk but ensuring high returns, unlike REITs, which invest in all kinds of properties. With this win-win formula of low risk and high returns, fractional ownership can be said to be similar to debt instruments and term insurance, while REIT is most similar to mutual funds, which can offer good returns but can also be more volatile.